Social media has become a powerful force in shaping investment trends and influencing financial decision-making. In this comprehensive guide, we’ll explore the growing influence of social media on investment behavior, its impact on stock markets, cryptocurrency trading, and investor sentiment, and how investors can navigate this evolving landscape.

1. The Rise of Social Media in Finance

Overview:

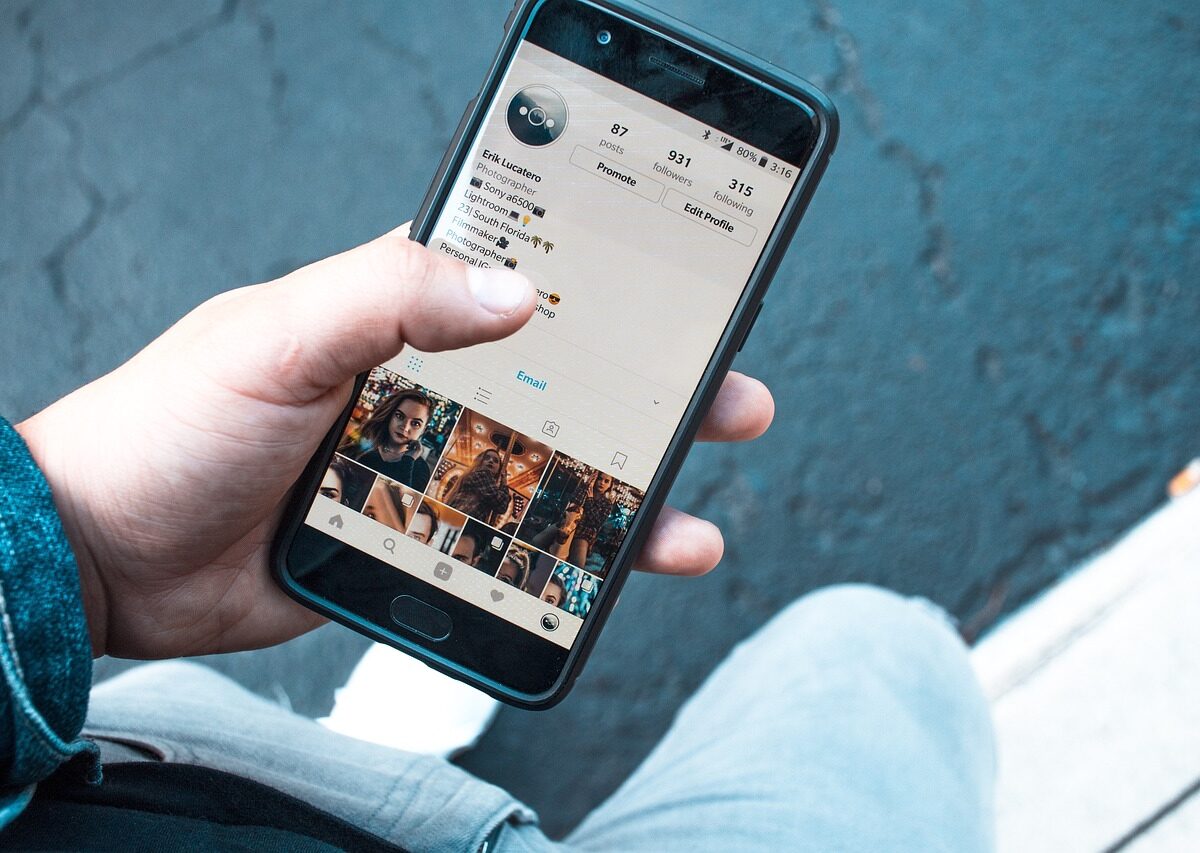

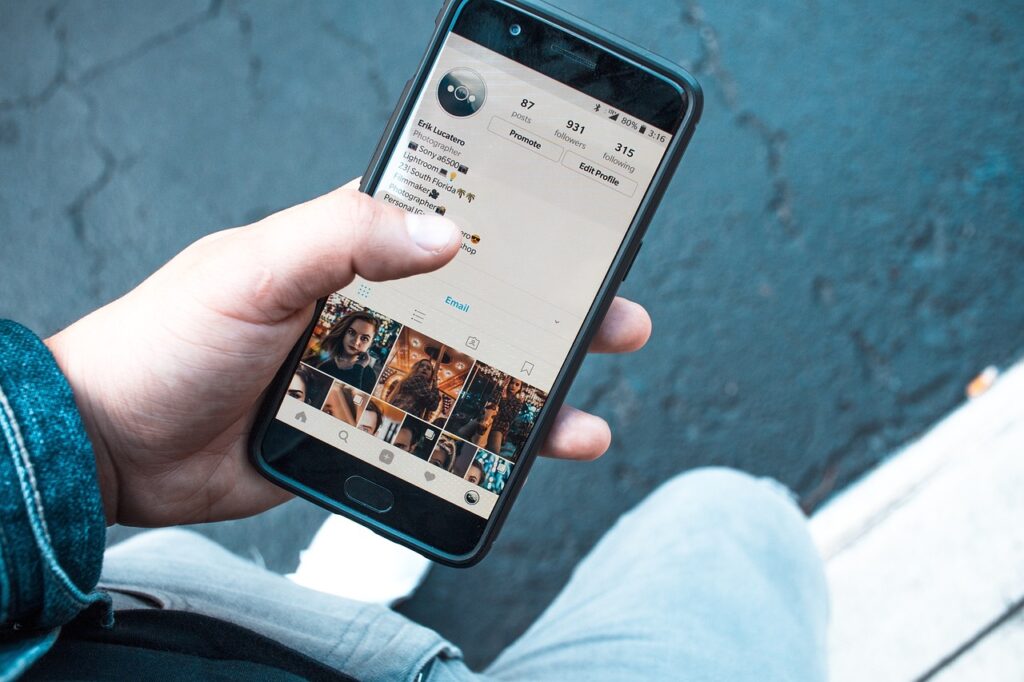

- Digital Connectivity: Social media platforms have revolutionized how individuals connect, communicate, and share information, including financial news, market analysis, and investment insights.

- Democratization of Information: Social media democratizes access to financial information, empowering retail investors with real-time market updates, expert opinions, and peer-to-peer discussions.

2. Social Media Platforms and Investment Communities

Engagement:

- Online Forums and Groups: Investment-focused communities on platforms like Reddit, Twitter, and Facebook provide forums for discussing investment strategies, sharing market insights, and crowd-sourcing investment ideas.

- Influencer Culture: Influential personalities, traders, and financial experts on social media platforms attract followers with market commentary, investment tips, and trading recommendations, shaping investor sentiment and market trends.

3. Impact on Stock Markets

Market Dynamics:

- Viral Trends: Social media can amplify market movements and trigger viral trends, such as meme stocks or short squeezes, driven by online discussions, memes, and user-generated content.

- Algorithmic Trading: Automated trading algorithms and sentiment analysis tools scrape social media data to gauge market sentiment, identify trends, and inform trading strategies, impacting market liquidity and volatility.

4. Cryptocurrency and Social Media

Digital Assets:

- Crypto Communities: Social media plays a significant role in shaping cryptocurrency markets, with online communities on platforms like Twitter and Discord driving awareness, speculation, and investment activity.

- Influencer Endorsements: Influencers and celebrities leverage social media platforms to promote cryptocurrencies, ICOs, and blockchain projects, influencing investor behavior and market sentiment.

5. Risks and Challenges

Considerations:

- Misinformation and Rumors: Social media can spread misinformation, rumors, and pump-and-dump schemes, leading to market manipulation, regulatory scrutiny, and investor losses.

- Herd Mentality: Herd mentality fueled by social media hype can drive irrational exuberance, speculative bubbles, and market frenzies, resulting in heightened volatility and investment risks.

6. Navigating Social Media as an Investor

Strategies:

- Due Diligence: Conduct thorough research and due diligence before making investment decisions, verifying information from multiple sources and critically evaluating the credibility of online sources.

- Risk Management: Practice risk management techniques, such as diversification, position sizing, and stop-loss orders, to mitigate the impact of market volatility and unforeseen events influenced by social media.

7. Regulatory Considerations

Oversight:

- Regulatory Scrutiny: Regulators monitor social media platforms for market manipulation, fraud, and compliance with securities laws, implementing measures to protect investors and maintain market integrity.

- Disclosure Requirements: Public companies and investment professionals must adhere to disclosure requirements when communicating on social media, ensuring transparency and fair disclosure of material information.

8. Ethical and Responsible Engagement

Guidelines:

- Ethical Conduct: Practice ethical and responsible engagement on social media, avoiding spreading false information, promoting pump-and-dump schemes, or engaging in market manipulation tactics.

- Educational Outreach: Educate and empower investors to critically evaluate information, exercise independent judgment, and make informed decisions based on fundamental analysis and risk assessment.

9. Conclusion

Social media has emerged as a powerful catalyst in shaping investment trends and influencing financial markets. While it offers opportunities for information sharing, collaboration, and community engagement, investors must exercise caution, conduct thorough research, and practice responsible investing behaviors to navigate the complexities of the digital landscape and achieve long-term financial success.