In the realm of borrowing, the rate of interest and loan terms hinge significantly on your credit score. A higher score translates to lower interest rates offered by banks, making it crucial to grasp how these scores are assessed and what they signify.

Your credit score serves as a pivotal yardstick for banks to gauge your creditworthiness – your ability to repay borrowed funds in a timely manner. It’s derived from a compilation of data within your credit report, encompassing details of credit accounts, payment history, existing debts, and overall financial conduct.

So, how do lenders interpret these credit scores?

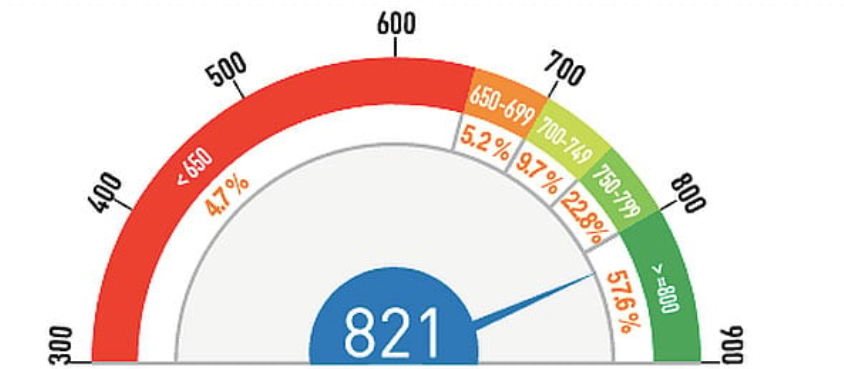

- Excellent Score: Scores soaring at 800 and above signal minimal risk to lenders. Borrowers boasting excellent credit scores are poised to secure the most enticing interest rates and loan terms available in the market.

- Good Credit: Falling within the 670 to 799 range, this bracket implies a relatively low risk for lenders. Individuals with good credit scores typically qualify for favorable terms, though not always the absolute best.

- Fair Credit: Scores ranging from 580 to 669 suggest a moderate risk profile. While borrowers within this range may still secure loans and credit cards, they might encounter higher interest rates and less favorable terms.

- Poor Credit: Scores dipping below 580 indicate heightened risk for lenders. Borrowers in this category may encounter challenges in qualifying for loans or credit cards, and if approved, they’ll likely face elevated interest rates and less favorable terms.

However, credit scores aren’t the sole determinant. Lenders factor in additional aspects like income, employment history, and existing financial commitments before extending credit. Moreover, each lender may uphold distinct criteria and risk thresholds.

Regularly monitoring your credit score and report is imperative for accuracy and to undertake measures for enhancement. Timely bill payments, maintaining modest credit card balances, and refraining from opening numerous accounts concurrently can contribute to score improvement.

Now, let’s address some common queries:

1. Does a High Credit Score Impact Loan Eligibility?

A resounding yes. A robust credit score substantially bolsters loan approval odds. Lenders favor individuals with higher scores, deeming them less prone to payment defaults.

2. Does a High Credit Score Expedite Loan Processing?

Indeed. A commendable credit score expedites the loan approval process. Banks are inclined to fast-track applications from borrowers with stellar credit histories.

3. How Does Credit Score Affect Loan Interest Rates?

Lenders typically extend more favorable terms, including lower interest rates and fees, to borrowers with superior credit scores.

4. Why Are Banks Favorable Toward High Credit Score Borrowers?

Banks perceive borrowers with high credit scores as less risky, translating to minimal chances of default and hence, lenient treatment.

5. What’s the Significance of Monitoring Credit Scores?

Regular credit score checks are imperative for maintaining financial well-being, offering insights into your overall fiscal health.

In essence, comprehending credit scores empowers individuals to make informed borrowing decisions, paving the way for financial stability and prosperity.